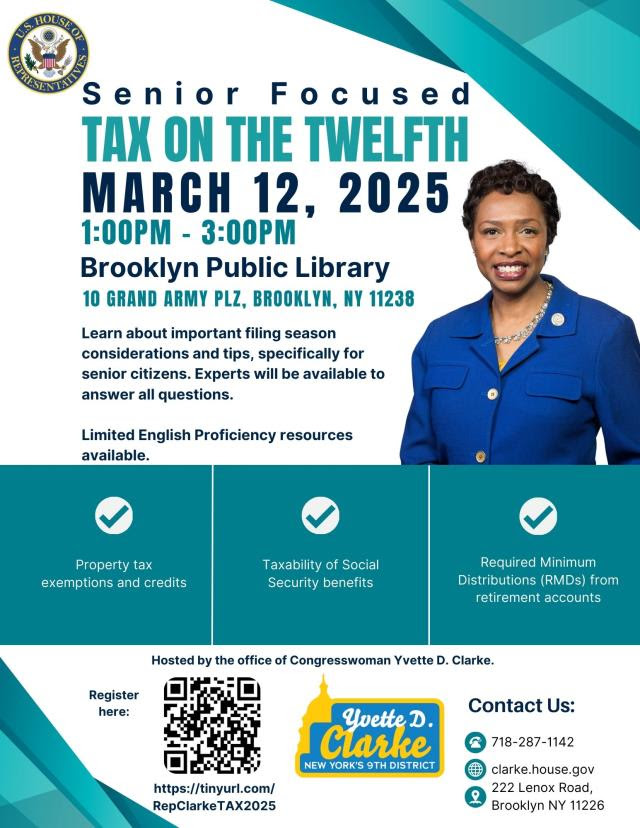

Senior Focus “Tax on the Twelfth” – Tax and Benefits Guidance Event

Learn about important filing season considerations and tips, specifically for senior citizens. Experts will be available to answer all questions:, including: property tax exemptions and credits, taxability of social security benefits, Required Minimum Distributions (RMDs) from retirement accounts.

Limited English Proficiency resources available.

Key Topics

- New Opportunity from IRS Direct Filing

- The Importance of Direct Deposit for IRS Refund

- IRS services for seniors and identity theft protection

- Taxability of Social Security Benefits

Services Offered

- Overview of Single Stop VITA Free Tax Preparation Services

- Guidance on document readiness and direct deposit for refunds

- Information on filing tax extensions and managing your refunds

This event provides relevant federal tax support and addresses key issues faced by the diverse population in the 9th Congressional District.

Take advantage of this valuable opportunity to learn about tax benefits and receive expert guidance.

RSVP at tinyurl.com/RepClarkeTAX2025

To RSVP or for more information, please contact Congresswoman Yvette Clarke’s office at 718.287.1142

CB14 posts community events on behalf of the organizers to help get the word out. Please note that this information may be out of date. Always contact the organizers to verify dates and locations and for up to date details, or if you would like more information.